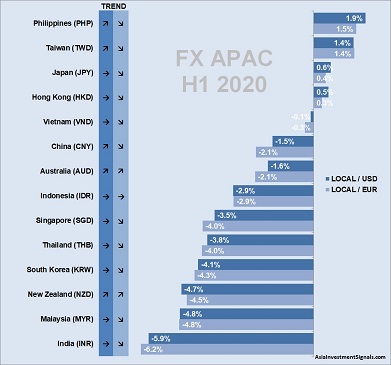

How did Asia-Pacific’s forex markets perform so far? The table beside gives a snapshot of the development of the different currencies in the Asia-Pacific region. The Philippine Peso and New Taiwan Dollar have increased the most against the USD and the EUR in the first half of this year.[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”]

How did Asia-Pacific’s forex markets perform so far? The table beside gives a snapshot of the development of the different currencies in the Asia-Pacific region. The Philippine Peso and New Taiwan Dollar have increased the most against the USD and the EUR in the first half of this year.[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”]

The Philippine Peso rose by almost two percent against the USD and one and a half percent against the EUR until the end of June. On the lower end of the table, the Indian Rupee, Malaysian Ringgit, New Zealand Dollar, and the South Korean Wong lost over four percent against the USD and the EUR over that same period.

Ten out of fourteen Asia-Pacific currencies, we follow lost or stayed flat against the USD and the EUR. The picture changed a bit in the last weeks as the USD is losing ground. The EUR continues to remain strong against most foreign currencies.

As a comparison, the USD Index, a measure of the value of the USD relative to a basket of six major foreign currencies, increased by only 0.3 percent in the first half of this year. The EUR Index, the unofficial equivalent index that represents the ratio of four major currencies against the Euro, increased by 3.7 percent over that same period.

The graph also shows the direction of the 50-day moving average for each currency against the USD (dark blue) and the EUR (light blue) as a short term trend indicator for the possible development in the near future.

[/mepr-active]