Stock markets around the world have been less affected by the COVID-19 pandemic than initially thought. Most markets largely recovered from the sharp drop in prices in March. And that despite a news flow that forecasts a rather bleak picture for the coming months. Indeed, numerous industries have been severely affected by the pandemic and have an uncertain future. But in our highly innovative and technological world, many companies and industries can defy such a global event or even benefit from it.[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”]

Stock markets around the world have been less affected by the COVID-19 pandemic than initially thought. Most markets largely recovered from the sharp drop in prices in March. And that despite a news flow that forecasts a rather bleak picture for the coming months. Indeed, numerous industries have been severely affected by the pandemic and have an uncertain future. But in our highly innovative and technological world, many companies and industries can defy such a global event or even benefit from it.[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”]

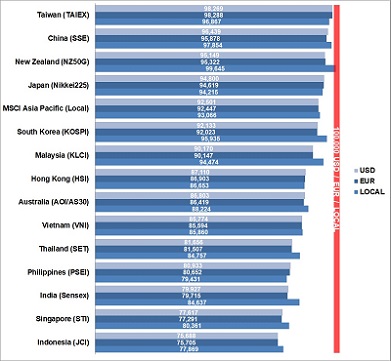

Our ranking shows that all markets in the Asia-Pacific region under review are still suffering losses since the beginning of this year. This applies to the USD and EUR based investors as well as to local investors.

Only small losses have experienced USD and EUR based investors, as well as local investors in Taiwan, China, and New Zealand. All three markets declined by only 0.4 to about 5 percent since the beginning of this year.

More significant losses experienced USD and EUR based, as well as local investors in India, the Philippines, Singapore, and Indonesia. The losses in these four markets reached between 20 and 24 percent since the beginning of this year.

After the massive drop until the end of the first quarter, the second quarter was characterized by a robust V-shaped recovery of the stock prices.

With a loss of over 30 percent, Vietnam was one of the most affected markets in the Asia-Pacific region at the end of Q1 but was then able to recover by a whopping 25 percent in Q2. South Korea, Taiwan, and Thailand followed with an increase of around 20 percent in Q2 after having plummeted between 19 and 30 percent in Q1.

The opinions among investors are controversial. Due to the pandemic, the optimists see increased pressure for more digitization in the economy and everyday life. They are expecting a further increase in stock prices over the next months, especially among technology companies. Pessimists expect stock prices to plummet again due to a possible second wave of COVID-19 infections and a sharp rise in unemployment and corporate insolvencies in the second half of the year. In any case, the second half of the year will remain challenging and exciting. Good luck!

[/mepr-active]