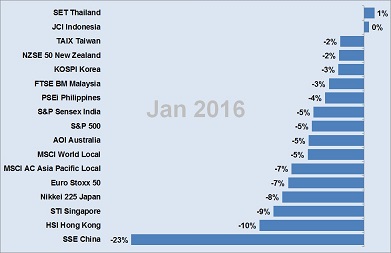

Wow, what are month! The press was full of negative statements and gloomy outlooks with comparisons to the financial crisis we have seen in 2007/08. But was this month really that bad? Or is this crisis only made by media? Let’s have a look at the performance across Asia’s market. OK, in case of Shanghai with 23% down we can really talk about a crash. But remember our blog post from autumn last year. China is a market dominated by many small investors.

Wow, what are month! The press was full of negative statements and gloomy outlooks with comparisons to the financial crisis we have seen in 2007/08. But was this month really that bad? Or is this crisis only made by media? Let’s have a look at the performance across Asia’s market. OK, in case of Shanghai with 23% down we can really talk about a crash. But remember our blog post from autumn last year. China is a market dominated by many small investors.

Unlike Western stock markets, where large institutional investors smooth market volatility, we have millions of small investors speculating at China’s stock market. These small investors can cause strong volatility. With the smallest mood swings these investors can initiate a domino effect that leads to periods of overreaction. China’s economy is actually not that bad. I read plenty of statements from business leaders of multinational companies who were still very positive about China. If the world understands and accepts that China cannot grow at a rate of 8% forever we will soon see again normal levels. China will remain a strong trading partner to the world.

Let’s have a look at the other Asian market. Hong Kong with 10% down has also been quite affected due to its proximity to China. Same applies to Singapore and Japan. Both countries are strong trading partners of the Middle Kingdom. But the rest of Asia does not look that bad. 3-5% down can be considered as a ‘normal’ bearish month or a regular consolidation. Nothing much to worry. On the top end we see Thailand and Indonesia which were hardly affected from any turbulence. For comparison we included major US and European Indices too. We expect this period of overreaction in some markets to continue for a few more weeks. But it is worth to keep the eyes open for the right moment and to follow the smart money when reentering the market.