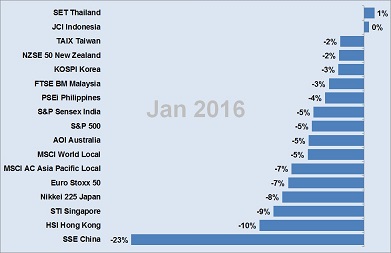

Wow, what are month! The press was full of negative statements and gloomy outlooks with comparisons to the financial crisis we have seen in 2007/08. But was this month really that bad? Or is this crisis only made by media? Let’s have a look at the performance across Asia’s market. OK, in case of Shanghai with 23% down we can really talk about a crash. But remember our blog post from autumn last year. China is a market dominated by many small investors. Continue reading “Much Ado About Nothing?”

Wow, what are month! The press was full of negative statements and gloomy outlooks with comparisons to the financial crisis we have seen in 2007/08. But was this month really that bad? Or is this crisis only made by media? Let’s have a look at the performance across Asia’s market. OK, in case of Shanghai with 23% down we can really talk about a crash. But remember our blog post from autumn last year. China is a market dominated by many small investors. Continue reading “Much Ado About Nothing?”

Category: Economy

What a 100K Investment in Asia Pacific Returned in 2015

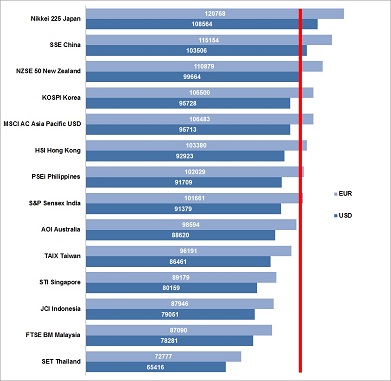

Here is what a 100,000 EUR or USD investment would have returned to an investor in 2015 when he or she would have invested in one of the following Asia Pacific stock markets. Best return with 20.8% has received an EUR based investor in Japanese stocks. Worst performance with -34.6% an USD based investor in Thailand stocks.

Here is what a 100,000 EUR or USD investment would have returned to an investor in 2015 when he or she would have invested in one of the following Asia Pacific stock markets. Best return with 20.8% has received an EUR based investor in Japanese stocks. Worst performance with -34.6% an USD based investor in Thailand stocks.

Asia – Gloomy Outlook for 2016

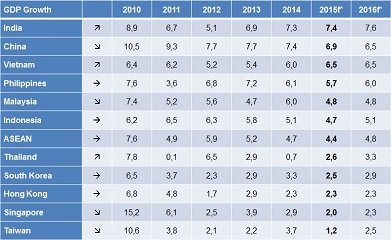

Japan’s Nomura Global Research expects a growth of only 5.7% for the Asian region ex-Japan in 2016. This will be the slowest pace since 1998.

Japan’s Nomura Global Research expects a growth of only 5.7% for the Asian region ex-Japan in 2016. This will be the slowest pace since 1998.

Little growth is expected in China, Hong Kong, South Korea, Taiwan, and Thailand. Malaysia and Indonesia are rated neutral with an expected GDP growth of 4.0% and 5.2% respectively. Singapore’s outlook is even negative with a forecasted GDP growth of only 1.8% in 2016. Continue reading “Asia – Gloomy Outlook for 2016”

Oil – Quo Vadis?

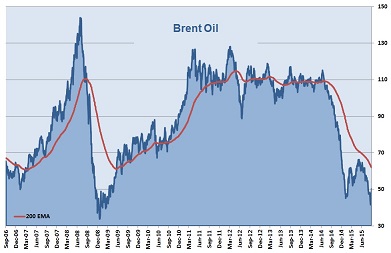

From a high at 145.46 USD in July 2008 Brent crude is now down about 66%. This corresponds to the level reached on October 2004. Reasons are manifold. Uncertainties in China and in the outlook of the world economy in general, the Saudis and OPEC who lost control of any price dictate and who are trying to push competitors out by producing as much as possible, new discovered oil production methods and reserves. The newspaper is full of speculative reasons about the future of the oil price. Continue reading “Oil – Quo Vadis?”

From a high at 145.46 USD in July 2008 Brent crude is now down about 66%. This corresponds to the level reached on October 2004. Reasons are manifold. Uncertainties in China and in the outlook of the world economy in general, the Saudis and OPEC who lost control of any price dictate and who are trying to push competitors out by producing as much as possible, new discovered oil production methods and reserves. The newspaper is full of speculative reasons about the future of the oil price. Continue reading “Oil – Quo Vadis?”