A year ago we have already commented on the battered Noble Group Ltd (N21.SI) in our blog post: Noble Group – Commodities aren’t Sexy at the Moment. Noble Group, which is named after the famous Hong Kong novel by James Clavell, was once a shining star and Asia’s biggest commodities house by revenue. Continue reading “Noble Group – 5 Signs for a Turnaround”

A year ago we have already commented on the battered Noble Group Ltd (N21.SI) in our blog post: Noble Group – Commodities aren’t Sexy at the Moment. Noble Group, which is named after the famous Hong Kong novel by James Clavell, was once a shining star and Asia’s biggest commodities house by revenue. Continue reading “Noble Group – 5 Signs for a Turnaround”

Tag: Commodities

Noble Group – Commodities aren’t Sexy at the Moment

Noble Group (N21.SI) is Asia’s largest commodity trader and one of China’s 20 biggest companies. With headquarter in Hong Kong and listing in Singapore, the company generated 2014 with 1,900 employees and a turnover of almost 86bn SGD an EBIT of 278m SGD. With a debt/equity ratio of 110% and a credit rating near junk level of BBB Noble Group is looking for new funding opportunities. Non-transparent and low commodity prices have made the company vulnerable to short speculations. Continue reading “Noble Group – Commodities aren’t Sexy at the Moment”

Noble Group (N21.SI) is Asia’s largest commodity trader and one of China’s 20 biggest companies. With headquarter in Hong Kong and listing in Singapore, the company generated 2014 with 1,900 employees and a turnover of almost 86bn SGD an EBIT of 278m SGD. With a debt/equity ratio of 110% and a credit rating near junk level of BBB Noble Group is looking for new funding opportunities. Non-transparent and low commodity prices have made the company vulnerable to short speculations. Continue reading “Noble Group – Commodities aren’t Sexy at the Moment”

Oil – Quo Vadis?

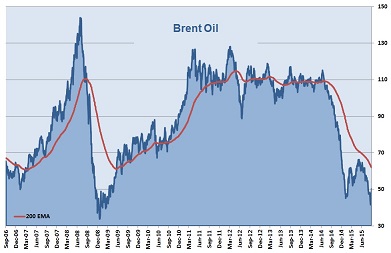

From a high at 145.46 USD in July 2008 Brent crude is now down about 66%. This corresponds to the level reached on October 2004. Reasons are manifold. Uncertainties in China and in the outlook of the world economy in general, the Saudis and OPEC who lost control of any price dictate and who are trying to push competitors out by producing as much as possible, new discovered oil production methods and reserves. The newspaper is full of speculative reasons about the future of the oil price. Continue reading “Oil – Quo Vadis?”

From a high at 145.46 USD in July 2008 Brent crude is now down about 66%. This corresponds to the level reached on October 2004. Reasons are manifold. Uncertainties in China and in the outlook of the world economy in general, the Saudis and OPEC who lost control of any price dictate and who are trying to push competitors out by producing as much as possible, new discovered oil production methods and reserves. The newspaper is full of speculative reasons about the future of the oil price. Continue reading “Oil – Quo Vadis?”