The first half of this year is over and it is time to draw the balance for this past six months. We have seen some strong up and down swings in the global markets so far. The setback in January with lows reached mid of February due to worries about China’s economy has affected most major markets around the world with strong links to Asia. The MSCI World Index has lost 13% until mid of February, while the MSCI Asia Pacific Index was down 16%. The UK referendum to leave the EU just a few days ago has caused some unexpected turbulences around the globe.

The first half of this year is over and it is time to draw the balance for this past six months. We have seen some strong up and down swings in the global markets so far. The setback in January with lows reached mid of February due to worries about China’s economy has affected most major markets around the world with strong links to Asia. The MSCI World Index has lost 13% until mid of February, while the MSCI Asia Pacific Index was down 16%. The UK referendum to leave the EU just a few days ago has caused some unexpected turbulences around the globe.

The MSCI World Index has lost 6% in two days, while the MSCI Asia Pacific Index was down 5%. Effects from the Brexit are still not fully digested, but markets have recovered fast. The medias and some piqued EU politicians have drawn a much too dramatic and gloomy picture. We don’t think that the Brexit will have many effects and will change major market trends. The FTSE has recovered unexpected well and has even reached a 10-months high on Friday. All in all the MSCI World Index is down just 3% this year, while the MSCI Asia Pacific Index has lost 9% on a local currency basis to date.

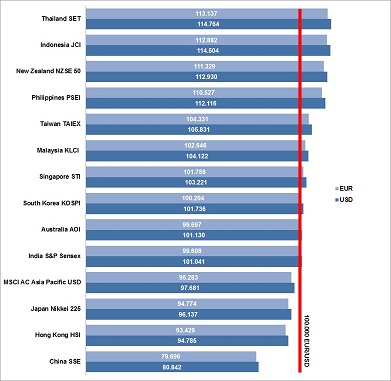

Our half year performance overview of the Asia Pacific markets shows that the trends we have seen in the first three months of this year (see First Quarter Performance of APAC Markets – Visible Trends) have not changed much. Thailand (12%), Philippines (12%), Indonesia (9%) and New Zealand (9%) have been the best performing markets in Asia Pacific on a local currency basis so far. On the downside we have Japan with minus 18% and China with minus 17% on a local currency basis.

The performance of the Asian Pacific markets looks only slightly different for a USD or a EUR investor. Taken into account the exchange rate fluctuations, the best performing market has been Thailand for a USD investor so far with a plus of around 15%, and a plus of around 13% for a EUR investor. A similar picture shows Indonesia (USD 15%/EUR 13%), New Zealand (13%/11%) and the Philippines (12%/11%). At the bottom of our performance list is China with a loss of around 19% for a USD investor and a loss of 20% for a EUR investor caused by the devaluation of the Renminbi. Japan looks much better for a foreign than for a local investor due to a strong gain of the Yen this year. Despite the strong decrease of the Nikkei Index with a minus of 18% this year, a USD investor has lost only 4%, while a EUR investor has lost only 3% to date.

What can we expect from the second half of this year? Major topics which the global markets will have to face in the next months will be the outcome of the US presidential election, the rising interest rates in the US, the never ending debt crisis in Greece which could make the country another candidate to leave the EU, and the remaining uncertainties about China’s economy. Positive signs come from the commodity markets recently. The bottom has most probably been reached and many commodities including oil show again up trending prices. This will boost economies of commodity exporting countries in Asia Pacific such as Indonesia and Australia.

For China and Japan we don’t expect a turnaround this year. The economic problems are still very present in both countries and their stock markets are still in a strong downtrend. The four top performing markets (Thailand, Philippines, Indonesia and New Zealand) will most likely continue to trend with further gains of another five to ten percent this year. The rest of the Asian Pacific markets might oscillate around zero to five percent including India, the country that most analysts have predicted to be the outperformer of the year.