For the US market, the January is believed to be a month with a predictive effect for rest of the year. The theory says that the direction of the S&P 500 during the month of January predicts the overall orientation of the stock market for the rest of year. [mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”] Although this January barometer has had an accuracy of more than 50% during a 20-year period, it seems difficult to produce excess returns by applying this strategy over a long term.

For the US market, the January is believed to be a month with a predictive effect for rest of the year. The theory says that the direction of the S&P 500 during the month of January predicts the overall orientation of the stock market for the rest of year. [mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”] Although this January barometer has had an accuracy of more than 50% during a 20-year period, it seems difficult to produce excess returns by applying this strategy over a long term.

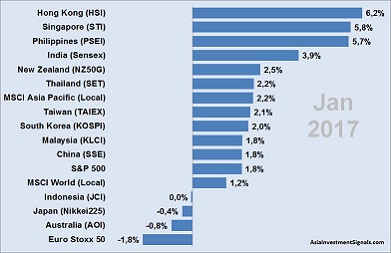

Without any empirical proof, we nevertheless believe that the January can give at least a good idea where the markets, in our case the APAC markets, are heading in the next months.

As can be seen in our graph, the best-performing markets in January with increases between 5% and 6% have shown the countries which have been among the weaker ones in 2016. Hong Kong 6.2% (unchanged in 2016), Singapore 5.8% (unchanged in 2016) and Philippines 5.7% (minus 2% in 2016).

India started well this year too with an increase of 3.9% in January, after an increase of only 2% for the entire year 2016.

New Zealand shows a continuous strong performance. After an increase of 14% in 2015 and 9% in 2016, the market advanced already 2.5% during the first month of this year.

Thailand, the top performer among the APAC markets with a 20% increase in 2016, advanced another 2.2% in January. While the second best performer, Indonesia (15% in 2016), remained unchanged in January. Taiwan, the third best performing market in APAC (11% in 2016) advanced 2.1% in January.

Malaysia and China, among the worst performing markets in 2016 with minus 3% and minus 12% respectively, started both with an increase of 1.8% in January.

In comparison, Euro Stoxx 50 contracted by 1.8% (unchanged in 2016), S&P 500 rose 1.8 % (10% in 2016), and the MSCI World remained unchanged (7% in 2016) in January.

We expect Hong Kong, Singapore, Philippines, and India to continue performing and to show possibly double-digit percent growth at the end of this year. New Zealand, Thailand, and Taiwan could progress further and end up performing between 5-10% at the end of this year.

[/mepr-active]