What would have a 100K USD, EUR or local currency investment returned to an investor in the first six months of 2017 if he or she would have invested in one of the Asia-Pacific equity markets? In our regular snapshot, we rank the performance of Asia Pacific’s stock markets on a USD, EUR, and local currency basis.[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”]

What would have a 100K USD, EUR or local currency investment returned to an investor in the first six months of 2017 if he or she would have invested in one of the Asia-Pacific equity markets? In our regular snapshot, we rank the performance of Asia Pacific’s stock markets on a USD, EUR, and local currency basis.[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”]

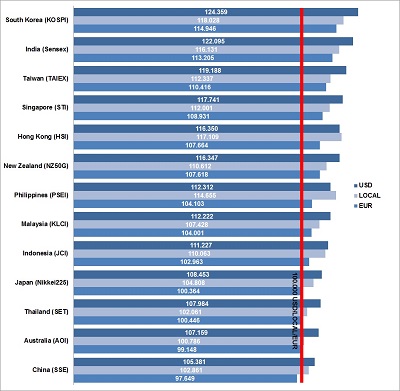

Best return with a gain of 24% would have received a USD based investor with South Korean stocks during the first six months of 2017. The worst performance with a loss of 2% would have experienced an EUR based investor with Chinese stocks.

The top performers during the last six months on a USD basis are South Korea (24%) followed by India (22%), Taiwan (19%), Singapore (18%) and Hong Kong (16%). The ranking remains the same for an EUR based investor, but he or she would have made slightly less return with only 15%, 13%, 10%, 9% and 8% respectively.

The ranking of the top performing Asian markets looks slightly different on a local currency basis. The top performers during the last six months on a local currency basis are South Korea (18%), followed by Hong Kong (17%), India (16%), Philippines (15%) and Taiwan (12%). While EUR based investors lost money on Chinese (-2%) and Australian (-1%) stocks, all local and USD based investors made at least some profits on the weakest markets in Asia Pacific.

Who gained and who lost momentum during the last months?

Hong Kong, who led the Asian markets end of January (6%), is now second best performer on a local currency basis. The Philippines, third best performing market in Asia end of January (6%), is still fourth best performer now. Singapore, second best performing market in Asia end of January (6%) and also the second best end of March (10%), has fallen back to a sixth place now due to a poor development of roughly 2% during the last three months.

Strongest performers in Q2 has been South Korea, who gained more than 10% during the last three months. The Philippines and Hong Kong followed with an increase of around 7% during the last three months. Worst performers in Q2 are Australia (-2%), China (-1%) and Thailand (0%).

See also: ‘APAC Markets – First Trends for 2017‘ and ‘First Quarter Performance of APAC Markets – India, Singapore and Hong Kong Ahead‘

[/mepr-active]