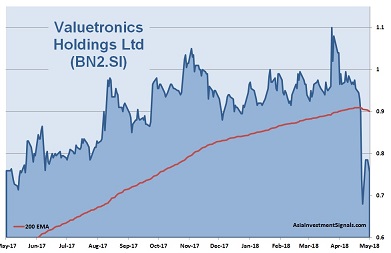

Valuetronics Holdings Ltd (BN2.SI) is a premier electronic manufacturing service provider for some of the world’s leading brands in consumer electronics and industrial and commercial electronics. Valuetronics designs and manufactures products such as printers, temperature sensing devices, communication and GPS products, data and media connectivity modules for cars, medical diagnostic equipment, as well as consumer lifestyle and smart lighting products with IoT features.

Valuetronics Holdings Ltd (BN2.SI) is a premier electronic manufacturing service provider for some of the world’s leading brands in consumer electronics and industrial and commercial electronics. Valuetronics designs and manufactures products such as printers, temperature sensing devices, communication and GPS products, data and media connectivity modules for cars, medical diagnostic equipment, as well as consumer lifestyle and smart lighting products with IoT features.

Please login or purchase a membership to view full text.