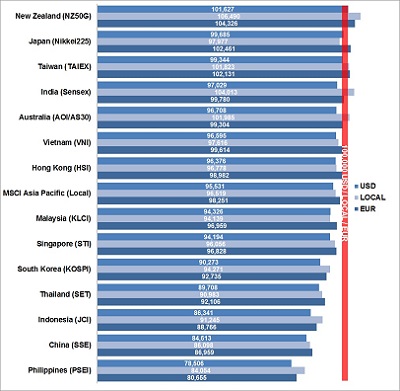

What would have a 100K USD, EUR or local currency investment returned to an investor in the first six months of 2018 if he or she would have invested in one of the Asia-Pacific equity markets? In our regular snapshot, we rank the performance of Asia-Pacific’s stock markets on a USD, EUR, and local currency basis.[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”]

What would have a 100K USD, EUR or local currency investment returned to an investor in the first six months of 2018 if he or she would have invested in one of the Asia-Pacific equity markets? In our regular snapshot, we rank the performance of Asia-Pacific’s stock markets on a USD, EUR, and local currency basis.[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”]

Best return with a gain of 6 percent would have received a local investor with New Zealand stocks over the first six months of 2018. The worst performance with a loss of 21 percent would have experienced a USD investor with Philippines stocks.

New Zealand has been the only APAC country to return a profit for a USD investor over the last six months. Japan and Taiwan remained almost flat with a performance between zero and minus one percent. Losses between 10 and 15 percent produced South Korean, Thailand, Indonesia, and China on a USD basis, followed by the Philippines with a decline of over 20 percent this year.

The ranking remains the same on an EUR basis, but with slightly better returns. Three APAC countries produced positive returns. New Zealand returned 4 percent to an EUR investor, followed by Japan and Taiwan with 2 percent each. Losses of more than 10 percent experienced EUR investors in Indonesia, China, and the Philippines this year.

The ranking looked hardly better on a local currency basis. Four APAC countries produced positive returns for local investors so far. New Zealand, India, Australia and Taiwan returned 6, 4, 2 and 2 percent respectively. Indonesia, Thailand, China and the Philippines ended up with losses between 9 and 16 percent for local investors over the last six months.

Rising US interest rates leading to a stronger USD, fear of adverse effects from trade barriers imposed by the US, fear of a slowing world economy and political uncertainties in some emerging markets are the primary reasons for the weak performance of many APAC markets this year.

Who gained and who lost momentum during last the three months?

Strongest performer in Q2 has been New Zealand, who had a hesitant start in Q1 but then showed a powerful momentum with an increase of almost 8 percent over the last three months. India, after some up and downs during Q1, showed the second best momentum in Q2 with an increase of 7 percent during the previous three months. Same can be said about Australia, which was down almost 5 percent at the end of Q1, and now rose 7 percent over the last three months.

Worst performers in Q2 with losses of 10 to 20 percent over the last three months have been the Philippines, China, Thailand, and Vietnam. Especially Vietnam, who has been up almost 13 percent in January, saw all its gains fading away and is down 2 percent now.

See also:

APAC Markets: First Trends for 2018

First Quarter Performance of APAC Markets – The Picture Has Changed

[/mepr-active]