Time flies. Only three months left until year end. Time again for our quarterly resume and outlook for the Asia-Pacific stock markets for the remaining period. October is known as the month with the highest volatility in the year. November and December, on the other hand, are often well performing months due to the tendency of a year-end rally.[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”]

Time flies. Only three months left until year end. Time again for our quarterly resume and outlook for the Asia-Pacific stock markets for the remaining period. October is known as the month with the highest volatility in the year. November and December, on the other hand, are often well performing months due to the tendency of a year-end rally.[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”]

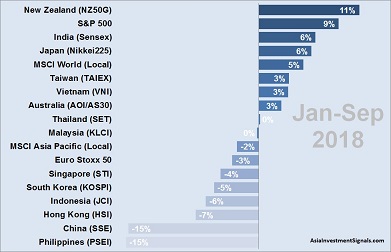

Our stock market performance ranking shows New Zealand, India, and Japan as the top three performing stock markets in the Asia-Pacific region this year with gains of 11, 6 and 6 percent respectively. New Zealand stalled at the beginning of the year and started to have a strong momentum only in Q2 and Q3 with increases of 8 and 5 percent respectively. India, on the other hand, began the year with a very dynamic performance of almost 6 percent in January, then gave up all profits during the following two months. Nearly all of India’s year-to-date performance is due to the second quarter gain of 7 percent.

Japan lost nearly 6 percent during the first three months of this year, then increased by 4 percent during Q2 and surprised with a powerful momentum of 8 percent in Q3, the second-best Q3 result in Asia-Pacific after Thailand. Japan is very likely to continue this strong momentum also in Q4 as the country seems to be rediscovered by more and more investors.

On the lower end of our ranking Philippines, China and Hong Kong with losses of 15, 15 and 7 percent respectively this year. Philippines and China have been badly hit particularly in Q2 where both countries declined by 10 percent during these three months. Hong Kong, who has been still a top performing market in January with an increase of almost 10 percent, gave up all profits over the following months and followed its big brother China.

All in all, the MSCI Asia-Pacific Index lost more than 2 percent on a local currency base and 5 percent on a USD base this year. The picture looks worse when Japan is excluded.

China has been strongly hit by the trade disputes with the US, and so did Hong Kong and some of China’s other trade partners in the Asia-Pacific region. The trade disputes with the US will be settled at some point in time. We believe this will happen even before year-end. China and Hong Kong stock markets could then bounce back as both markets look oversold and have still a very reasonable valuation of 11 and 13 times earnings respectively. It is worth to keep a close eye on these two markets.

[/mepr-active]