Every quarter we like to visualize and rank the performances of the major stock market indices around Asia Pacific in a bar chart to give a quick and comparative view on developments and trends that might be indicative for the direction over the next few months.[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”]

Every quarter we like to visualize and rank the performances of the major stock market indices around Asia Pacific in a bar chart to give a quick and comparative view on developments and trends that might be indicative for the direction over the next few months.[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”]

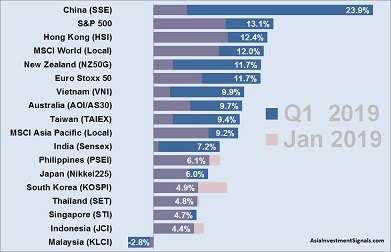

We have also added in the graph the January performances (light red) to show where the smart money has been flowing over the last two months. The ranking has changed considerably since our snapshot end of January this year (see APAC Markets: First Trends for 2019).

The top five performers in our Asia Pacific regional ranking over the first quarter are now China, Hong Kong, New Zealand, Vietnam, and Australia., which have replaced January’s top performer South Korea, Philippines, Indonesia, and Thailand. Only Hong Kong remained under the top five so far.

On the lower end of the ranking, Indonesia, Singapore, Thailand, and South Korea, which have gained between four and five percent over the first three months, and Malaysia, the only APAC country which remained in the red with a loss of now 2.8 percent. Except for Singapore, all other four markets lost up to three percent during February and March.

The smart money has been flowing into China, which increases by almost 20 percent during February and March, New Zealand (9.4 percent), Vietnam (7.9 percent), Taiwan (7.1 percent) and India (6.7 percent). Singapore, Thailand, and Japan hardly advanced over the last two months and ended the first quarter with gains between four and six percent.

In comparison, the Euro Stoxx 50 rose by 6.1 percent during the last two months with a year-to-date performance of now 11.7 percent, S&P 500 gained 4.8 percent during the previous two months to now 13.1 percent, and the MSCI World increased 4.5 percent to now 12 percent.

All in all Asia Pacific’s stock markets followed the global recovery after the massive decline over the fourth quarter of 2018 which was already seen as the end of the longest bull market. Greater China performed surprisingly well so far despite the trade conflicts with the US. Investors seem confident that a mutually beneficial solution is ahead soon. Much investor’s confidence remained in New Zealand, which already performed well in 2018 and increased by 11.7 percent this year.

The current picture on the stock markets does not match with the fear of slowing down economies worldwide. The rally over the last months might be more driven by cash and a lack of alternative investments than by underlying fundamentals. Caution is advised as investor’s sentiment can change quickly. We are skeptical if this double-digit growth in some countries will last until the end of the year. Markets tend to rise on a wall of worries and peak when optimism is highest. We will have a look at GDP developments in the region in our next posts. Stay tuned!

[/mepr-active]