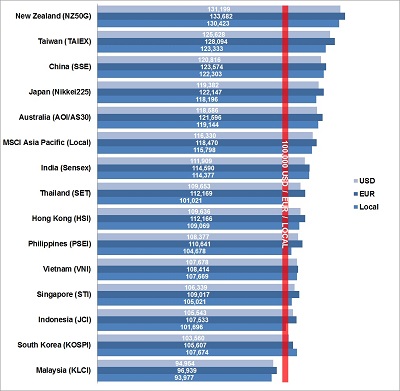

What would have a 100K USD, EUR, or local currency investment returned to an investor in 2019 if he or she would have invested in one of the Asia-Pacific equity markets? In our regular snapshot, we rank the performance of Asia-Pacific’s stock market indices on a USD, EUR, and local currency basis.

What would have a 100K USD, EUR, or local currency investment returned to an investor in 2019 if he or she would have invested in one of the Asia-Pacific equity markets? In our regular snapshot, we rank the performance of Asia-Pacific’s stock market indices on a USD, EUR, and local currency basis.

The highest returns with 34 percent would have made a EUR based investor with New Zealand stocks in 2019.[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”] The biggest loss with minus 6 percent would have experienced a local investor with Malaysian shares. Malaysia remained the only APAC market with losses for local, USD, and EUR based investors in 2019. All other APAC markets produced returns between 1 and 34 percent.

New Zealand has not only been the best performing market in APAC but is also a market that continuously produced positive returns for many years already. Taiwan turned out to be the second-best performing APAC market with a performance of 23 percent last year. And despite the clash with the US, China ended up third in our APAC ranking with a double-digit return of 22 percent for a local, and 24 percent for a EUR based investor.

On the lower end with single-digit returns have been Thailand, Indonesia, the Philippines, and Singapore. Despite the massive turmoil in China’s special administrative region, Hong Kong rallied 8 percent over the last quarter and finished the year 2019 with a return of 9 percent.

The strongest momentum over the last three months of 2019 showed Taiwan, with an increase of 11 percent, followed by Japan with 9 percent. On the lower end are Thailand and Vietnam, which both lost 4 percent over the last quarter of 2019.

What will be the best-performing Asia-Pacific markets in 2020? Many analysts predict great opportunities for APAC countries in 2020. Let’s see the market momentum in January. The performance and ranking during the first month of the year can sometimes be a good indicator to forecast the development for the next few months. Stay tuned for our next performance snapshot, which we will post early February.

[/mepr-active]