Sunny Optical Technology (Group) Company Ltd (2382.HK) is China’s biggest producer of handset camera modules and the world’s second-largest manufacturer of mobile camera lenses. The company focuses on optoelectronic products, such as handsets, digital cameras, vehicle imaging, sensing and security surveillance systems, and VR/AR products that are combined with optical, electronic, software, and mechanical technologies. [mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”]Sunny Optical Technology clients include Huawei, Xiaomi, Oppo, and Vivo. Rumors are around that the company may become an Apple supplier very soon.

Sunny Optical Technology (Group) Company Ltd (2382.HK) is China’s biggest producer of handset camera modules and the world’s second-largest manufacturer of mobile camera lenses. The company focuses on optoelectronic products, such as handsets, digital cameras, vehicle imaging, sensing and security surveillance systems, and VR/AR products that are combined with optical, electronic, software, and mechanical technologies. [mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”]Sunny Optical Technology clients include Huawei, Xiaomi, Oppo, and Vivo. Rumors are around that the company may become an Apple supplier very soon.

Sunny Optical Technology operates through three segments. The optoelectronic business contributed about 75 percent to the revenues and grew by 27 percent over the first half-year of 2020. The other two segments, optical components (lenses, plane products, handset lenses, vehicle lenses, security surveillance lenses) and optical instruments (microscopes, intelligent inspection equipment), contributed to only 24 and 1 percent respectively to the revenues.

About 86 percent of the business is made in China. Sales in this market grew by 31 percent over the first half-year 2020, while sales in other markets dropped mostly due to the temporary trade turbulences caused by the pandemic. The company has six production bases in China, India, and Vietnam and three R&D centers in China, the US, and South Korea. Sunny Optical Technology is on Forbes’ Global 2000 list and a constituent of Hong Kong’s Hang Seng Index.

Sunny Optical Technology was founded in 1984 and is headquartered in Yuyao, China. The company is listed on the main board of Hong Kong’s stock exchange since 2007. Its shares can also be traded in Germany, the US, UK, and Mexico. The company’s directors hold together around 35 percent of the shares. 62 percent of the shares are in public hands.

With a workforce of over 21 thousand employees, Sunny Optical Technology reported revenues of 18.9bn RMB (2.9bn USD) and profits before tax of 2.1bn RMB (328m USD) over the first half of the year 2020. This is an increase of 21 and 28 percent respectively compared to the same period a year ago. In its full-year 2019, revenues and profits increased by 46 and 60 percent, respectively. The operating margin (TTM) of almost 13 percent is well above industry average. Sunny Optical Technology’s cash reserves decreased by 6 percent to 1.8bn RMB (278m USD), while debts and lease obligations increased by 16 percent to 6.6bn RMB (1bn USD) over the first half-year 2020.

Sunny Optical Technology shows a stable balance sheet with good profitability and financial strength. The equity ratio is at 44 percent, and the gearing, defined here as total liabilities to total equity, at still acceptable 127 percent. Moody’s current rating of Sunny Optical Technology is Baa2, with a daily credit risk score of 7, indicating higher risks based on a day-to-day movement in market value compared to the company’s liability structure. The next earning results will be announced in mid of March.

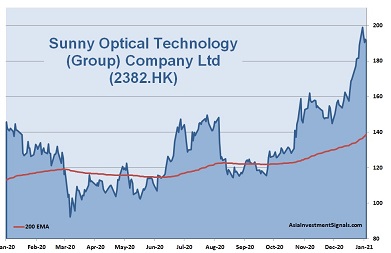

Sunny Optical Technology’s shares are in an intact long-term uptrend since June 2019 and gained more than 138 percent in value since, 13 percent increase alone this year. The company is currently priced at 44 times earnings, 14 times book value, and 34 times operating cash flow. The forward dividend yield is less than one percent. 31 out of 41 analysts have a ‘buy’ or ‘outperform’ recommendations on the stock.

Our conclusion: Sunny Optical Technology shows stable financial positions with good profitability and financial strength. The valuation is high but comes with a steady annual growth rate for revenue and profits of 32 and 47 percent, respectively, over the last five years. Optoelectronic components, whether as cameras or sensors, are finding more and more areas of application. In smartphones and cars, they are an essential criterion for purchasing decisions. The outlook for Sunny Optical Technology should therefore remain positive for the coming years. The company is well-positioned in a strong competitive environment. Assuming a stable global economy, we expect the share price to increase another 15 to 20 percent this year.

AIS Rating: ★★★★☆

| 2015 | 2016 | 2017 | 2018 | 2019 | 2020 H1 Only |

|

|---|---|---|---|---|---|---|

| EPS (RMBcents) | 70.3 | 116.7 | 265.6 | 227.3 | 364.2 | 159.6 |

| Change (%) | 34 | 66 | 128 | (14) | 60 | 22 |

| DPS (HKDcents) | 24.9 | 32.3 | 81.2 | 66.2 | 81 | n/a |

| P/E | P/E INDUSTRY |

P/B | P/CF | Equity Ratio* (%) |

ROE (%) |

LIAB./ Equity** (%) |

Div YLD (%) |

|---|---|---|---|---|---|---|---|

| 44 | 26 | 14 | 34 | 44 | 36 | 127 | 0.4 |

* Equity / Total Assets, ** Total Liabilities / Equity

[/mepr-active]