Fisher & Paykel Healthcare Corp Ltd (FPH.NZ) is one of the world’s three largest respiratory device manufacturers. The company manufactures products and systems for acute and chronic respiratory care, surgery, and obstructive sleep apnea treatment. With three production facilities in New Zealand and Mexico, Fisher & Paykel Healthcare sells its products in more than 120 countries worldwide based on a multi-channel distribution model.[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”]< The company focuses highly on innovation and investment in R&D. It spends about 7 percent of its revenues and dedicates more than 10 percent of its staff for its own research and development. The company holds over 1,800 patents worldwide, with another 1,800 pending.

Fisher & Paykel Healthcare Corp Ltd (FPH.NZ) is one of the world’s three largest respiratory device manufacturers. The company manufactures products and systems for acute and chronic respiratory care, surgery, and obstructive sleep apnea treatment. With three production facilities in New Zealand and Mexico, Fisher & Paykel Healthcare sells its products in more than 120 countries worldwide based on a multi-channel distribution model.[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”]< The company focuses highly on innovation and investment in R&D. It spends about 7 percent of its revenues and dedicates more than 10 percent of its staff for its own research and development. The company holds over 1,800 patents worldwide, with another 1,800 pending.

Fisher & Paykel Healthcare targets both the hospital and homecare market. Hospital products accounted for about 76 percent of the total revenues and grew by 87 percent last year. This exceptional growth was largely driven by demand for its products used to treat COVID-19 patients. Homecare products contributed 24 percent to the revenues but increased by 2 percent only. Recurring items, consumables, and accessories account for about two-thirds of the company’s revenue.

Fisher & Paykel Healthcare earns about 42 percent of the revenues in North America, 32 percent in Europe, and 18 percent in Asia-Pacific. The European business grew by a whopping 73 percent last year, while North America and Asia-Pacific increased by 45 and 27 percent, respectively.

Fisher & Paykel Healthcare was founded in 1934 and is headquartered in Auckland, New Zealand. The company is listed on both the Australian and the New Zealand stock exchanges since 2001. Its shares can also be traded in Germany and the US. The largest shareholder is JPMorgan Chase Bank, with ownership of around 10 percent. The seven directors of Fisher & Paykel Healthcare held together only 0.3 percent of the company. About 95 percent of the shares are in public hands.

With a workforce of almost 6,900 employees, Fisher & Paykel Healthcare reported revenues of 1.97bn NZD (1.4bn USD) and profits before tax of 718m NZD (500m USD) in its FY 2020/21 ending 31.March. This is an increase of 56 and 94 percent respectively compared to the same period a year ago. In FY 2019/20, revenues and profits increased by 18 and 27 percent, respectively. The operating margin of 35 percent is well above the industry average. Fisher & Paykel Healthcare’s cash reserves increased by 45 percent to 97m NZD (68m USD), while debts and lease obligations have been reduced by 13 percent to 118m NZD (83m USD) in 2020/21. The company shows a robust balance sheet with excellent profitability and financial strength. The equity ratio is 73 percent, and the gearing, defined here as total liabilities to total equity, at 36 percent. The next earning results will be announced in November this year.

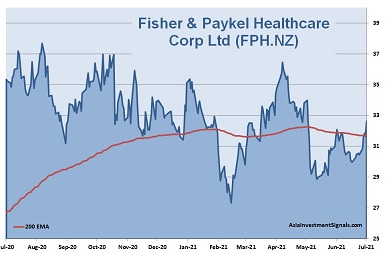

Fisher & Paykel Healthcare’s shares have been uptrend since 2013 and have increased more than twelve-fold since then, 47 percent increase alone since 2020. The company is currently priced at 36 times earnings, 12 times book value, and 30 times operating cash flow. The latest dividend yielded around 1.1 percent. Currently, only 2 out of 7 analysts have a ‘buy’ or ‘outperform’ recommendation.

Our conclusion: Fisher & Paykel Healthcare shows healthy financial positions with excellent profitability and financial strength. The valuation is high but comes with a consistent annual growth rate for revenue and profits of 26 and 38 percent, respectively, over the last three years. Fisher & Paykel Healthcare’s long-term goal is sustainable yearly revenue growth of at least 12 percent, basically doubling its revenue every 5 to 6 years.

The company had an exceptionally high demand for its products since the pandemic broke out. However, it should not be overlooked that Fisher & Paykel Healthcare showed already good growth figures before Covid-19. The exceptional growth in hardware sales is unlikely to be repeated after the end of the pandemic. Nevertheless, Fisher & Paykel Healthcare will have gained many new customers by that time and is well-positioned to benefit from a change in clinical practice in the future. Assuming a stable global economy, we expect the share price to increase by at least 15 to 20 percent over the next 12 months.

AIS Rating: ★★★★☆

| 2015/16 | 2016/17 | 2017/18 | 2018/19 | 2019/20 | 2020/21 | |

|---|---|---|---|---|---|---|

| EPS (NZDcents) | 25 | 30 | 33 | 36 | 50 | 90 |

| Change (%) | 26 | 18 | 12 | 10 | 37 | 82 |

| DPS (NZDcents) | 17 | 20 | 21 | 23 | 28 | 38 |

| P/E | P/E INDUSTRY |

P/B | P/CF | Equity Ratio* (%) |

ROE (%) |

LIAB./ Equity** (%) |

Div YLD (%) |

|---|---|---|---|---|---|---|---|

| 36 | 34 | 12 | 30 | 73 | 42 | 36 | 1.2 |

* Equity / Total Assets, ** Total Liabilities / Equity

[/mepr-active]