Government bond yields around the world are on the rise. How does the situation look in the Asia-Pacific region? Are there alternatives to the stock market to park money safely and with some profits?

Government bond yields around the world are on the rise. How does the situation look in the Asia-Pacific region? Are there alternatives to the stock market to park money safely and with some profits?

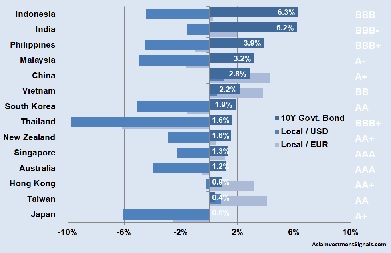

The graph shows the current yields for 10-year government bonds (dark blue) in the Asia-Pacific region.[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”] On the right side of the chart, the Standard & Poor country rating, which indicates the long-term credit ratings for those sovereign bonds. According to S&P, a bond is considered investment grade if its credit rating is BBB- or higher. Ratings of BB+ and below are supposed to be speculative or junk grades. Furthermore, the graph shows the change in the local currency against the US Dollar (middle blue) and the Euro (light blue) since the beginning of this year.

10-year government bond yields are highest in Indonesia with 6.3 percent, followed by India (6.2 percent) and the Philippines (3.9 percent). Japanese government bonds yield nearly zero percent on the lower end of the list, followed by Taiwan (0.4 percent) and Hong Kong (0.9 percent).

The graph is a snapshot and shows only part of the picture this year. Most government bond yields rose over the first seven months of this year, which means that prices for corresponding futures contracts have fallen. Only Vietnam, China, and Japanese government bond futures have increased in prices this year.

In addition, a foreign investor faces currency exchange fluctuations and risks. For the US and a European-based investor, only Chinese and Vietnamese government bonds would have returned some significant profits up to date due to the combination of futures price and local currency increase. Therefore, from a risk perspective, only a Chinese treasury bond futures with a rating of A+ and a stable outlook would have made sense to hold so far.

[/mepr-active]