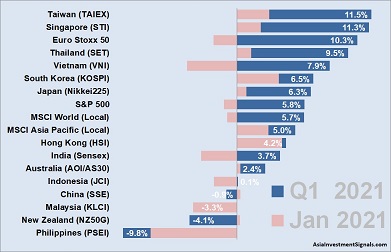

Despite the dip in early March, most stock markets continue to rise. Our quarterly ranking shows the performance of Asia Pacific’s major stock market indices over the first quarter.

Despite the dip in early March, most stock markets continue to rise. Our quarterly ranking shows the performance of Asia Pacific’s major stock market indices over the first quarter.

The top five performers in our Asia Pacific ranking over the first quarter show Taiwan, Singapore, Thailand, Vietnam, and South Korea in the first places.[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”] Taiwan, which had already the second-best performing market in 2020 with 23 percent, grew another 12 percent over the first three months of this year. Singapore and Thailand were both among the three worst-performing stock markets in the Asia Pacific in 2020, made up lost ground, and grew by more than 11 and 9 percent respectively this year. Vietnam showed a stunning turnaround this year. Its stock market lost about 4 percent in January but rallied almost 13 percent over the two consecutive months, ending up with a gain of 8 percent at the end of Q1.

On the lower end of the ranking are the Philippines, New Zealand, and Malaysia. The Philippines, which had the second worst-performing stock market with a loss of 9 percent last year, declined another 10 percent over the first quarter this year. New Zealand, which prides itself on its pandemic management, showed only average performance in 2020 and lost about 4 percent in Q1, making it the second-worst performing market in this region this year. Malaysia continues its downtrend, which started in April 2018 already.

All hope rests on an early end to the pandemic. However, it remains uncertain whether this will be achieved by the end of this year. What is certain, however, is that the end of the pandemic will bring a new upswing. The deprivations in consumption, travel, and the restricted life will be followed by a wave of joy and relief, which will also positively affect the economy. The markets have already factored in some of these expectations.

The graph above also includes the January performances (light red) to show where the smart money has been flowing over the last two months. Investments fled mostly into Vietnam, which increased by almost 13 percent during February and March, Singapore (9.1 percent), and Taiwan (8.5 percent). In comparison, the Euro Stoxx 50 rose by about 13 percent over the last two months with a year-to-date gain of about 10 percent now, S&P 500 gained 7 percent during the previous two months to now about 6 percent, and the MSCI World increased by almost 7 percent to now almost 6 percent.

[/mepr-active]