Last year’s high flyer Japan led the list of the best-performing markets in Asia-Pacific in January. Our regular ranking of the stock markets in Asia-Pacific in January shows possible trends over the next few months.

Last year’s high flyer Japan led the list of the best-performing markets in Asia-Pacific in January. Our regular ranking of the stock markets in Asia-Pacific in January shows possible trends over the next few months.

January is said to have some predictive power for the rest of the year. It shows how large market participants position themselves at the beginning of the year and into which markets the money flows in and out. Studies for the US market show that if January ends with a positive return, the probability of ending the year with a profit is around 90 percent. Although this statistic applies to the US market, we see similar effects in other stock markets. On the other hand, markets that were among the biggest losers in the previous year often show a certain catch-up potential in the first few weeks of a new year. But this year seems different.

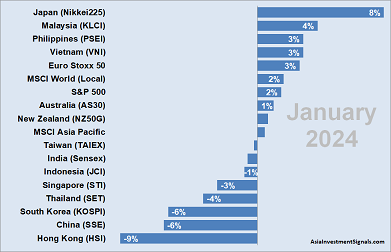

6 out of 14 markets we monitor in Asia-Pacific increased in January. In contrast, three markets have lost over 5 percent since the beginning of the year.

The MSCI World Index and the S&P 500 Index rose by 2 percent in January. The leading European index, the Euro Stoxx 50, has increased by 3 percent since the beginning of the year. The MSCI Asia-Pacific index, however, remained unchanged in January. Markets in Asia-Pacific, which had already had a weak performance last year, continued to decline in January. Hong Kong lost 9 percent in January, after a minus of 14 percent in 2023. The same can be observed in Thailand and China. Both markets fell by 4 and 6 percent in January after declining by 15 and 4 percent in the previous year. South Korea is also one of the losers in January, with a decline of 6 percent, although this market was still one of the best in 2023.

The year promises to remain exciting. Geopolitical tensions with China, a war with an uncertain outcome in Ukraine, and the Israel-Gaza conflict which could still escalate into a conflagration in the region. After Taiwan and Indonesia, other important elections are coming up this year, including in the US, India, and South Korea. Inflation in the US and Europe still doesn’t seem to have been contained. Therefore, the longed-for interest rate cut remains uncertain for now. Let’s see.