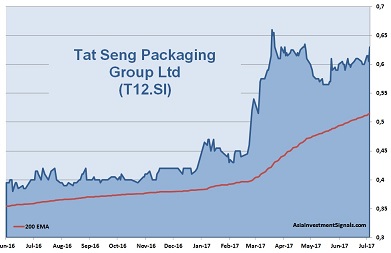

Tat Seng Packaging Group Ltd (T12.SI) value has increased 50% since our first recommendation last year in June. The manufacturer of corrugated paper products and packaging is also part of our model portfolio. With a market cap of 70m USD, Tat Seng Packaging is only a relatively small player. However, the well-managed company has consistently surprised with positive results over the past five years and shows strong financials. EPS grew by 27% over the last five years, a rate well above industry average. Continue reading “Tat Seng Packaging – Still a Bargain”

Tat Seng Packaging Group Ltd (T12.SI) value has increased 50% since our first recommendation last year in June. The manufacturer of corrugated paper products and packaging is also part of our model portfolio. With a market cap of 70m USD, Tat Seng Packaging is only a relatively small player. However, the well-managed company has consistently surprised with positive results over the past five years and shows strong financials. EPS grew by 27% over the last five years, a rate well above industry average. Continue reading “Tat Seng Packaging – Still a Bargain”

Tag: Singapore Listing

Valuetronics Holdings – Still a Good Investment

Valuetronics Holdings Ltd (BN2.SI) is one of the top performers in our Asia Pacific Model Portfolio since December 2015 (see our posting ‘Valuetronics – Value for Money’). The provider of Electronic Manufacturing Service (“EMS”) has gained 63% since our first recommendation and is up 30% since the beginning of this year. Continue reading “Valuetronics Holdings – Still a Good Investment”

Valuetronics Holdings Ltd (BN2.SI) is one of the top performers in our Asia Pacific Model Portfolio since December 2015 (see our posting ‘Valuetronics – Value for Money’). The provider of Electronic Manufacturing Service (“EMS”) has gained 63% since our first recommendation and is up 30% since the beginning of this year. Continue reading “Valuetronics Holdings – Still a Good Investment”

China Sunsine Chemical Holdings – A Value Investment with Specialty Chemicals

China Sunsine Chemical Holdings Ltd (CH8.SI) is a leading producer of specialty chemicals. The company is the world’s largest producer of rubber accelerator with a global market share of 17% and China’s largest producer of insoluble sulfur. China Sunsine Chemical has over 700 customers and serves 65% of the world top 75 tire manufacturers, such as Bridgestone, Michelin, Goodyear, Pirelli. The products are distributed under the brand name ‘Sunsine’. Continue reading “China Sunsine Chemical Holdings – A Value Investment with Specialty Chemicals”

China Sunsine Chemical Holdings Ltd (CH8.SI) is a leading producer of specialty chemicals. The company is the world’s largest producer of rubber accelerator with a global market share of 17% and China’s largest producer of insoluble sulfur. China Sunsine Chemical has over 700 customers and serves 65% of the world top 75 tire manufacturers, such as Bridgestone, Michelin, Goodyear, Pirelli. The products are distributed under the brand name ‘Sunsine’. Continue reading “China Sunsine Chemical Holdings – A Value Investment with Specialty Chemicals”

Dutech Holdings – On Shopping Tour in Germany

Dutech Holdings Limited (CZ4.SI) is a leading global manufacturer of high-security products. The company sells safes for Automated Teller Machines (ATM) in the banking industry, safes for commercial and residential purposes, cash handling systems and intelligent terminals. Continue reading “Dutech Holdings – On Shopping Tour in Germany”

Dutech Holdings Limited (CZ4.SI) is a leading global manufacturer of high-security products. The company sells safes for Automated Teller Machines (ATM) in the banking industry, safes for commercial and residential purposes, cash handling systems and intelligent terminals. Continue reading “Dutech Holdings – On Shopping Tour in Germany”

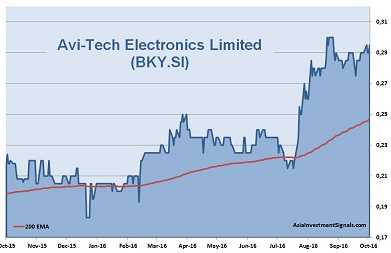

Avi-Tech Electronics – Growing demand from the Internet of Things

Avi-Tech Electronics Ltd (BKY.SI) provides burn-in services and manufacturing, printed circuit board assembly (“PCBA”) services, and engineering services for OEMs in the semiconductor, electronics, and life sciences industries. It also manufactures digital imaging systems for the life sciences industry. Continue reading “Avi-Tech Electronics – Growing demand from the Internet of Things”

Avi-Tech Electronics Ltd (BKY.SI) provides burn-in services and manufacturing, printed circuit board assembly (“PCBA”) services, and engineering services for OEMs in the semiconductor, electronics, and life sciences industries. It also manufactures digital imaging systems for the life sciences industry. Continue reading “Avi-Tech Electronics – Growing demand from the Internet of Things”

Noble Group – 5 Signs for a Turnaround

A year ago we have already commented on the battered Noble Group Ltd (N21.SI) in our blog post: Noble Group – Commodities aren’t Sexy at the Moment. Noble Group, which is named after the famous Hong Kong novel by James Clavell, was once a shining star and Asia’s biggest commodities house by revenue. Continue reading “Noble Group – 5 Signs for a Turnaround”

A year ago we have already commented on the battered Noble Group Ltd (N21.SI) in our blog post: Noble Group – Commodities aren’t Sexy at the Moment. Noble Group, which is named after the famous Hong Kong novel by James Clavell, was once a shining star and Asia’s biggest commodities house by revenue. Continue reading “Noble Group – 5 Signs for a Turnaround”