Despite many uncertainties in the world starting from the US-China trade dispute to Brexit, US-Iran tensions, and a cooling down global economy, the Asia-Pacific markets performed remarkably well during the first six months of this year. A significant consolidation or even crash that has been predicted since quite a while by many market analysts has not occurred so far. The markets continue to rise on a wall of worries.[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”]

Despite many uncertainties in the world starting from the US-China trade dispute to Brexit, US-Iran tensions, and a cooling down global economy, the Asia-Pacific markets performed remarkably well during the first six months of this year. A significant consolidation or even crash that has been predicted since quite a while by many market analysts has not occurred so far. The markets continue to rise on a wall of worries.[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”]

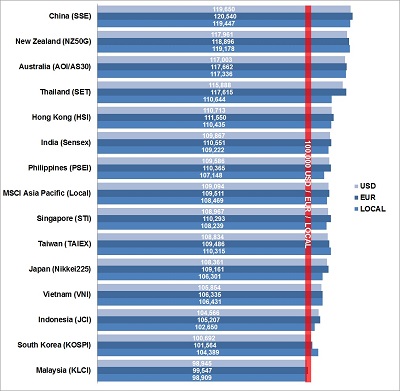

In our regular snapshot of what a 100K USD, EUR or local currency investment would have returned to an investor, we are ranking the performance of Asia-Pacific’s stock markets over the first half year 2019.

Best return with a gain of more than 20 percent would have made a EUR based investor with Chinese stocks over the first six months of this year. The worst performance, but with a loss of just 1 percent, would have experienced a local investor with Malaysian shares.

Except for Malaysia, all APAC markets generated returns between 1 to 21 percent for a local, EUR or USD based investor over the first half year 2019. However, the loss of around one percent in Malaysia’s market remained relatively small. Other weak performers have been South Korea and Indonesia with returns between 1 and 5 percent. The MSCI Asia Pacific Index, the stock market index reflexing the whole APAC region, performed between 8.5 and 9.5 percent, depending on the currency invested.

Who gained and who lost momentum during the last three months?

Best performers in Q2 with increases of 7 percent on a local currency basis have been Australian and New Zealand. Both countries performed already well in Q1 with returns of 10 and 12 percent respectively. Thailand, who showed already a remarkable performance of 5 percent in January, increased by another 6 percent during the last three months.

Weakest performers in Q2 with losses up to 4 percent over the last three months have been Japan, South Korea, Indonesia, Hong Kong, Vietnam, and China. China gained almost 24 percent until the end of Q1 but then gave up 4 percent during Q2 as a result of a worsening trade dispute with the US. South Korea, who has been second-best performer in January with a gain of 8 percent, gave up half of that performance over the following five months.

A cooling down global economy will undoubtedly have more impact on the markets in the second half of this year. A possible solution in the US-China trade dispute might therefore only have limited effects on the APAC markets. We are carefully optimistic, but we don’t expect further gains in the second half of this year.

See also:

APAC Markets: First Trends for 2019

APAC Markets: First Quarter Performances

[/mepr-active]