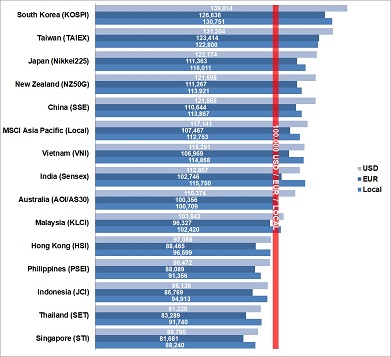

The black swan couldn’t have been blacker. A look back at the stock markets in Asia-Pacific of this extraordinary, unpredictable, and dramatic year 2020. What would have an investment of 100K USD, EUR, or local currency returned if invested in one of the Asia-Pacific stock markets in 2020? Our regularly ranking shows the returns based on USD, EUR, and local currency.

The black swan couldn’t have been blacker. A look back at the stock markets in Asia-Pacific of this extraordinary, unpredictable, and dramatic year 2020. What would have an investment of 100K USD, EUR, or local currency returned if invested in one of the Asia-Pacific stock markets in 2020? Our regularly ranking shows the returns based on USD, EUR, and local currency.

The highest return with 39 percent would have made a USD investor with South Korean stocks in 2020.[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”] The most significant loss with minus 18 percent would have experienced a EUR investor with Singaporean shares. Singapore has been the only APAC market with double-digit losses for all three investors, the local, the USD, and the EUR investor, in 2020.

The year 2020 was mostly favorable for the USD investor due to the weakening US Dollar. The USD Index, a measure of the value of the USD relative to a basket of six major foreign currencies, lost almost 7 percent over the last year. Eight out of fourteen APAC markets produced therefore double-digit returns for the USD investor. Only five APAC markets ended with double-digit growth for EUR investors, on the other hand.

Remarkable, the Vietnamese, the South Korean, the Indian, and the Taiwanese market. These four APAC markets bounced back more than 50 percent since the corona crash last March. And South Korea and Taiwan produced returns between 20 and 30 percent over the whole last year for all three investors, the local, the USD, and the EUR investor.

On the lower end, Hong Kong, the Philippines, Indonesia, Thailand, and at the very end Singapore. These stock markets lost between 3 and 18 percent, depending on the investor’s base currency.

The best-performing markets over the last quarter of 2020 have been India, South Korea, and Indonesia, which returned around 25 percent in these three last months.

Which country or region will make the race in 2021? Many analysts see good opportunities for the Asia-Pacific region this year. There are many reasons to invest in this region: Many Asian countries have mastered the pandemic well so far and will continue to do so. The weak US Dollar makes it easier for some emerging economies to deleverage. Trade between Asian countries is becoming increasingly important. Asia represents an alternative to the now very high valuated western markets. And finally, China’s endeavor to take a leading role in the world will attract more investments to this region.

Let’s see the first trends in the stock markets at the end of January. The performance and the ranking at the end of January can sometimes give a first indicator of the market developments over the next few months. Stay tuned for our next performance snapshot, which we will post in early February.

See also:

What a 100K Investment in Asia-Pacific Returned in H1 2020

[/mepr-active]