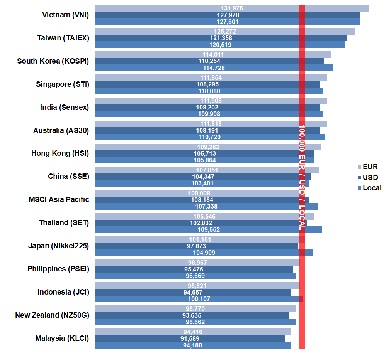

What a 100K USD, EUR, or local currency investment would have returned in Asia-Pacific’s stock markets over the last half-year. Our regularly ranking shows the returns for a USD-, EUR-, and local-based investor.

What a 100K USD, EUR, or local currency investment would have returned in Asia-Pacific’s stock markets over the last half-year. Our regularly ranking shows the returns for a USD-, EUR-, and local-based investor.

The highest return with 32 percent would have made a EUR investor in the Vietnamese stock market over the first six months of 2021. A loss of 8.4 percent would have experienced a USD investor with Malaysian shares over this period.[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”]

The first half-year of 2021 was favorable primarily for the EUR investors. 6 out of the 14 Asia-Pacific stock markets on our ranking have produced double-digit returns between 12 and 32 percent for the EUR investor. This gain was partly due to the weakening of the EUR against many Asia-Pacific currencies over that period. Only 3 Asia-Pacific markets produced double-digit returns for the USD investor, while 6 Asia-Pacific markets produced double-digit returns for a local investor.

Remarkable, the outperformance of the Vietnamese stock market in the second quarter. After a negative start at the beginning of this year, the Vietnamese stock market showed strong momentum over the following months and gained, especially in the last three months, a whopping 18 percent. The Taiwanese market, which has been already the top-performing Asia-Pacific market over the first quarter, continued its strong performance for the following three months with a gain of 8 percent.

A disappointment has been the Thailand and Japanese stock markets for a USD investor. While the two markets gained 9.6 and 4.9 percent, respectively, the two local currencies lost over 7 percent and ruined these investments so far.

On the lower end of our ranking, Malaysia, New Zealand, and the Philippines. These three stock markets have been weak since the beginning of this year and have continued their downwards trend.

It is not easy to make a forecast for the second half of this year. The markets have already received a lot of early praise for the hoped-for quick end of the pandemic. So far, however, it is still completely unclear when the pandemic and its related restrictions in many countries will end. Even if tourism and travel have had only minor effects on the global economic recovery so far, continues restrictions in these sectors and their supply chains will soon affect other industries. Unless there is a major medical miracle in sight in the next few weeks or months, we expect investors to be more wait-and-see and the markets to move sideways in the second half of the year.

See also:

APAC Markets: First Quarter Performances

APAC Markets: First Trends in 2021

[/mepr-active]