Three months are left until this year-end. Time for our quarterly resume for Asia-Pacific’s stock markets for the remaining period. October is statistically known as the month with the highest volatility in the year. November and December as two well-performing months due to the tendency for a year-end rally. Currently, the markets seem undecided on which direction to take for the rest of the year.[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”] There is uncertainty about the effects of supply bottlenecks, rising inflation, and the influence of the state on the large tech companies in China. Seasonal effects also lead furthermore to greater volatility in the markets in September and October.

Three months are left until this year-end. Time for our quarterly resume for Asia-Pacific’s stock markets for the remaining period. October is statistically known as the month with the highest volatility in the year. November and December as two well-performing months due to the tendency for a year-end rally. Currently, the markets seem undecided on which direction to take for the rest of the year.[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”] There is uncertainty about the effects of supply bottlenecks, rising inflation, and the influence of the state on the large tech companies in China. Seasonal effects also lead furthermore to greater volatility in the markets in September and October.

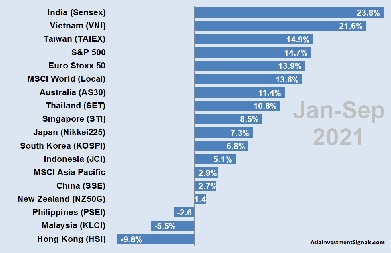

Looking back this year, our stock market performance ranking shows that most Asia-Pacific markets have produced a positive return so far. Eight of our 14 Asian markets observed showed double-digit growth, with India and Vietnam as the top performers this year. India returned almost 24 percent this year, while Vietnam increased by nearly 22 percent.

Only three APAC markets showed losses this year. The most significant loss experienced Hong Kong with almost 10 percent, followed by Malaysia with 5.5 percent.

Over the last three months, India had the most substantial increase with 13 percent, followed by Indonesia (5 percent) and New Zealand (5 percent). Hong Kong and South Korea were the biggest looser over the last quarter, with 15 and 7 percent, respectively.

The MSCI Asia-Pacific Index gained 2.9 percent on a local currency base and lost 1.3 percent on a USD base this year. We also included the MSCI World, the S&P 500, and the EURO STOXX 50 Index in the graph for comparison.

[/mepr-active]