Pandemic, natural disasters, inflation, supply chain disruptions, geopolitical risks with China and Russia, Tech and MEME stock rallies … the year 2021 was far from being boring.

Pandemic, natural disasters, inflation, supply chain disruptions, geopolitical risks with China and Russia, Tech and MEME stock rallies … the year 2021 was far from being boring.

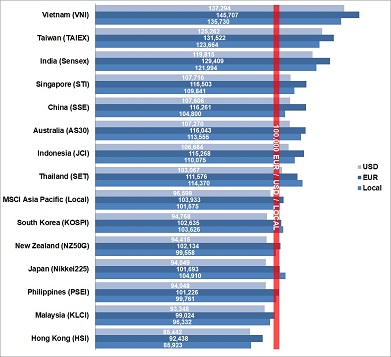

Looking back on the stock markets in 2021, what would have an investment of 100K USD, EUR, or local currency returned for an investor in Asia-Pacific? Our regularly ranking shows US Dollar, EUR, and local investors’ returns.[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”]

Overall, the Asia-Pacific stock markets returned only 2 percent in 2021 when measured with the MSCI Asia-Pacific Index on a local basis. But this is not the full picture. Only two APAC markets ended the year with a loss. 7 out of 14 APAC markets we track produced even double-digit returns on a local basis.

The highest return of 46 percent would have made a EUR investor with Vietnamese stocks in 2021. On the other hand, the most significant loss of 15 percent would have experienced a US Dollar investor with Hong Kong shares last year. Hong Kong has been the only APAC market with double-digit losses for a US Dollar investor and a local investor in 2021.

The year 2021 was primarily favorable for EUR investors due to the weakening of the European currency. The EUR Index, a measure of the value of the EUR relative to a basket of four major foreign currencies, lost more than five percent over the year 2021. Eight out of 14 APAC markets produced double-digit returns for a EUR investor. Only two APAC markets ended up with losses for the EUR investor.

Hong Kong and Malaysia ended the year with losses for all three, the US Dollar, the EUR, and the local investors, and are on the bottom of our stock market performance ranking. Over the year, the rising US Dollar produced further losses for investments in South Korea, New Zealand, Japan, and the Philippines markets for a US investor only.

Best performers over the last quarter of 2021 have been Vietnamese and Taiwanese stocks with returns of 12 and 8 percent, respectively, over these previous three months.

Which country or region will make the race in 2022? As in the previous year, many analysts remain optimistic for the APAC region in 2022. There are still many reasons for investments in this region: Many Asian countries have so far mastered the pandemic very well. Trade between Asian countries is becoming increasingly important. The latest wave of regulations that has staggered many Chinese stocks will slowly fade away. Asia still represents an alternative to the now very high valued Western markets. And China’s endeavor to take more and more a leading role in the world might attract further investments to this region. On the other hand, a strong dollar and rising interest rates will make it harder for some emerging economies to deleverage.

Let’s see the first trends in the stock market performances at the end of January. The performance and the ranking at the end of this month are the first signals for the market developments over the following months. Stay tuned for our next performance snapshot, which we will post in early February.

See also: What a 100K Investment in Asia-Pacific Returned in H1 2021

[/mepr-active]