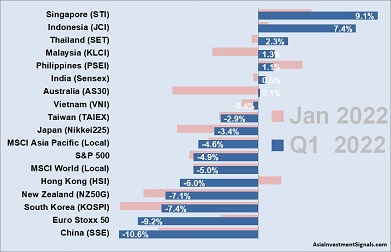

Our quarterly ranking shows the performance of Asia Pacific’s major stock market indices over the first quarter.

Our quarterly ranking shows the performance of Asia Pacific’s major stock market indices over the first quarter.

The top three performers in the first quarter are Singapore, Indonesia, and Thailand. Singapore was the best performing market in APAC in January and followed up on this trend over the next two consecutive months with a return now of 9.1 percent.[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”] Indonesia gained momentum in the last two months and is now the second-best performing market in APAC, with a return of 7.4 percent. Thailand dropped one percent in January but made up almost 3 percent over the next two consecutive months, now at 2.3 percent.

China, South Korea, and New Zealand are on the lower end of the ranking. China, the third worst-performing APAC market in January, continued to drop another three percent over the last two months, with a loss of 10.6 percent now. South Korea was the worst-performing APAC market in January, down 11 percent, but has reduced some losses over the last two months to now 7.4 percent. Similar to New Zealand, which dropped 9 percent in January and has been able to catch up slightly to a loss of 7.1 percent.

We have added to the graph the January performances (light red) to show where the smart money has been flowing over the last two months. Australia, Indonesia, and Malaysia have benefited from increases between 5 to 7 percent over February and March. Australia and Malaysia are also at a turning point to climb from a loss of 7 and 4 percent in January to positive territory now.

The Euro Stoxx 50 and S&P 500 are down by 9.2 and 4.9 percent, respectively this year, the MSCI World lost 5 percent, and the MSCI Asia Pacific Index lost 4.6 percent.

The adverse effect of the pandemic and the shock of the war in Ukraine are slowly fading away. If no new surprises are coming, inflation and rising interest rates remain the two threats to worry about. A significant rise in energy costs and other commodities prices might put the global economy at risk. The question is how much the markets have already anticipated these negative effects on the current prices.

[/mepr-active]