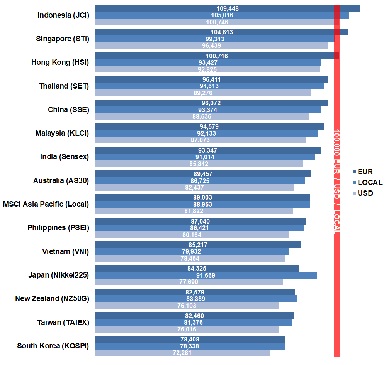

What a 100K USD, EUR, or local currency investment would have returned in Asia-Pacific’s stock markets over the last half-year. Our regularly ranking shows the returns for a USD-, EUR-, and local-based investor.

What a 100K USD, EUR, or local currency investment would have returned in Asia-Pacific’s stock markets over the last half-year. Our regularly ranking shows the returns for a USD-, EUR-, and local-based investor.

The highest return, with 9.4 percent, would have made a EUR investor in the Indonesian stock market over the first six months of 2022. The most significant loss, with 27.7 percent, would have experienced a USD investor with South Korean shares over this period.[mepr-active membership=”1734″ ifallowed=”show” unauth=”message” unauth_message=”Please login or purchase a membership to view full text.”]

There have been only a few profitable markets in APAC over the first half-year of 2022. Most of the profits went into the pocket of EUR investors. 3 out of the 14 Asia Pacific markets on our ranking have produced decent returns between one and 9 percent for the EUR-based investor. The gains were primarily due to the weakening EUR against the USD and many APAC currencies over that period. Only the Indonesian market produced returns for all three investors, roughly one percent for the USD- and about 5 and 9 percent for the local and the EUR-based investor.

Remarkable is the outperformance of Chinese stocks in the second quarter. After a negative start in January and over the first quarter of this year, Chinese stock gained momentum in the second quarter and increased by 5 percent despite an adverse trend in the rest of the world. China has been the only APAC market that rose in the second quarter of this year.

A disappointment has been the South Korean markets for all three investors, the USD, the EUR, and the local-based, who have suffered losses between 22 and 28 percent so far. The Taiwanese and New Zealand markets are also on the lower end of our ranking, with losses between 17 and 24 percent. South Korea and New Zealand continued a negative trend, which was already visible in January.

Two scenarios are possible for the second half of this year. A faster-than-expected end to the war in Ukraine could brighten the sentiment among investors and lead to a price rally towards the end of this year. However, should the war drag on beyond year-end, supply bottlenecks, inflation, rising interest rates, geopolitical risks, and fear of a recession could continue to keep the markets down. Well, let’s hope for the best!

[/mepr-active]